What Happens When You are a Loan Guarantor in Kenya—and the Borrower Fails to Pay

Introduction: Guarantors Carry the Burden When Borrowers Fail

In Kenya, it’s common for friends, family, or colleagues to ask you to guarantee a loan—whether it’s a quick mobile loan, a SACCO loan, or even a large bank or logbook loan.

But what happens when the borrower doesn’t pay?

Many guarantors are shocked to discover that they're legally responsible for the full loan balance. Depending on the type of loan, you can be listed on CRB, sued, or even lose your savings or assets—all because you agreed to help someone else secure a loan.

This article breaks down what happens when a loan goes unpaid, based on the type of loan, and what your rights and options are as a guarantor in Kenya.

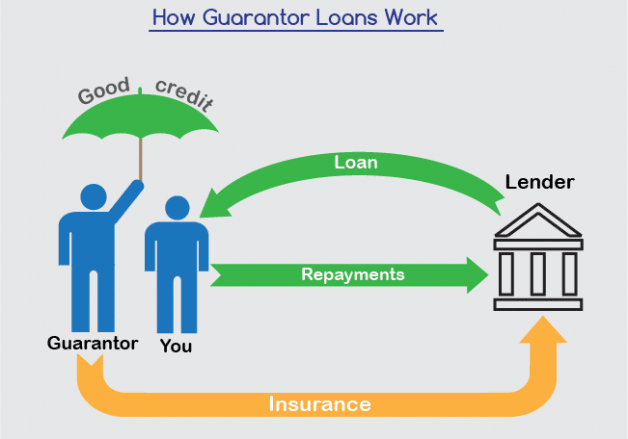

1. General Rule: A Guarantor Is Legally Liable If the Borrower Defaults

Across the board—whether it's a mobile app loan, SACCO credit, or bank financing—a guarantor is legally bound to repay the loan if the borrower doesn’t.

This means:

- The lender can pursue you for the unpaid amount

- You can be listed on the Credit Reference Bureau (CRB)

- You may lose assets or savings, especially in SACCO and logbook loans

- You may have to pay in full, even if the borrower disappears

But how this plays out depends on the type of loan.

2. Mobile Loans: Quick Cash, Big Risks for Guarantors

Popular mobile loans in Kenya include Fuliza, Tala, M-Shwari, Zenka, Okash, and others. Some SACCO-backed apps also allow borrowers to add phone contacts as guarantors.

What Happens When a Mobile Loan Isn't Paid

- You may get constant calls and SMS harassment

- Some apps threaten to expose your contacts—which is illegal under data protection laws

- If your ID number or phone was linked to the loan, you can be listed on CRB as a defaulter

What You Can Do

- Check if you truly consented to be a guarantor

- Dispute the CRB listing if you never agreed to it

- File a complaint with the Office of the Data Protection Commissioner (odpc.go.ke)

3. SACCO Loans: Guarantors Pay Through Their Savings

In SACCOs, guarantorship is standard practice. To qualify for a loan, many SACCOs require 2–3 guarantors whose savings secure the loan.

What Happens When the Borrower Fails to Pay

- The SACCO will first notify the borrower

- If they fail to pay, the SACCO starts deducting the guarantors' savings

- If the deductions aren’t enough, you may be required to top up the difference in cash

- Guarantors cannot withdraw savings until the loan is cleared

What You Can Do

- Talk to the borrower and agree on a repayment plan

- Request the SACCO to restructure or extend the loan

- In some SACCOs, you can resign as guarantor before the loan is disbursed (check the SACCO’s bylaws)

- If you pay the loan, you can sue the borrower to recover your money

4. Bank Loans: Signed Documents Mean Court-Level Responsibility

When you guarantee a bank loan in Kenya, it typically involves:

- Signing a guarantor agreement

- Submitting a copy of your ID and KRA PIN

- Sometimes even offering collateral

If the Borrower Defaults

- The bank contacts you to recover the amount

- You may be listed on CRB

- If you fail to pay, the bank may take you to court

- The court can order salary deductions, property attachment, or auctions

What You Can Do

- Request loan performance updates from the bank

- Negotiate with the bank to reschedule payments

- If you pay the debt, you can file a civil suit to recover funds from the borrower

5. Logbook Loans: Repossession Doesn’t Always End It

With logbook loans, a car’s logbook is used as collateral. However, guarantors are still at risk.

What Happens When the Borrower Fails to Pay

- The car is repossessed without notice

- If the sale of the car doesn’t cover the full loan, you pay the balance

- Recovery actions can escalate quickly, and repossession is often done aggressively

- You could be listed on CRB or taken to court for the shortfall

What You Can Do

- Always verify the car’s value and loan balance before agreeing to be a guarantor

- Ask to be notified before the car is auctioned

- If you’re forced to pay, consider legal recovery action against the borrower

6. Are There Legal Protections for Guarantors in Kenya?

Yes. Kenyan law recognizes the rights of guarantors—but only if you were misled, did not consent, or were not properly informed.

Key Legal Points

- A guarantor agreement must be in writing (Law of Contract Act)

- You can only be held liable if you clearly agreed to be a guarantor

- If you’re forced to pay, you have the right to recover the money from the borrower

- If your data was used without consent, you can report it to the Office of the Data Protection Commissioner

What To Do If You’re Asked to Be a Guarantor

Before saying “yes,” always:

- Ask for a copy of the loan agreement

- Understand how much you are liable for

- Check if there are other guarantors

- Get written confirmation of your obligations

- Keep a close eye on the loan performance

- Know the SACCO or lender’s recovery policy

💡 Pro tip: If you must guarantee someone, make sure you are able and willing to pay the loan in case things go wrong—because legally, you might have to.

Final Thoughts: Guarantorship Is a Financial Contract, Not a Favor

Many Kenyans say “yes” to being guarantors out of love, loyalty, or friendship. But once the borrower defaults, lenders won't chase them first—they’ll chase you.

Before agreeing, treat it like a loan you’re taking yourself. Ask questions, read documents, and prepare for the worst-case scenario. And if you’ve already guaranteed someone who defaulted, take action early to protect your finances and credit record.

Remember!

If you need a logbook loan, contact us through our contact form, call us on +254791573231 or visit one of our branches across Nairobi, Kiambu, Machakos, and Kajiado counties to explore your financial options.

Comments ()