Processes, Pitfalls, and Checklist for Buying an Imported Car in Kenya through Hire Purchase

While the allure of imported cars is undeniable, navigating Kenya's import process and financing options can feel like driving through unfamiliar territory. But don't let that discourage you –this comprehensive guide will steer you through the essentials of importing a car through hire purchase, helping you avoid costly wrong turns while making your automotive dreams a reality. Buckle up as we break down everything you need to know about importing your dream car through hire purchase in Kenya.

Key Processes to Follow When Buying an Imported Car through Hire Purchase

1.Identify a Trusted Dealer or Importer

- The first step is to find a reputable car dealer or importer who offers hire purchase options. Look for established companies with good reviews and valid licenses.

- Verify that the dealer has a history of delivering cars as promised. Ask for

recommendations from people who have successfully bought cars through hire purchase.

2.Confirm the Car’s Importation Status

- Before making any financial commitments, ensure that the vehicle has cleared customs and has a valid import declaration form (IDF).

- Verify that the car was legally imported and that the necessary duties and taxes have been paid. You can check this through the Kenya Revenue Authority (KRA) or request proof from the dealer.

3.Review the Hire Purchase Agreement

- The hire purchase contract should clearly outline the payment terms, interest rates, and the total cost of the vehicle.

- Make sure that the agreement specifies what happens in case of default and whether any penalties are involved for late payments.

- Read the fine print carefully, as some dealers may include hidden fees or conditions that could make the deal less favorable.

4.Check Vehicle Documentation

- Even though the car may not yet be registered by the Kenyan government, you should request all the original importation documents, including:

o Bill of Lading

o Certificate of Conformity (CoC)

o Clearance certificate from KRA (if already cleared) - These documents will be necessary when you proceed with the registration process.

5.Insurance Requirements

- When buying a car through hire purchase, most companies require the car to be fully insured.

- Ensure that the insurance covers theft, damage, and accidents. Some companies may require you to purchase comprehensive insurance before handing over the vehicle.

6.Registration Process

- Once you have agreed on the hire purchase terms and have made your initial payment, you will need to register the vehicle with the Kenyan government.

- The registration process involves:

o Submitting the importation documents to NTSA (National Transport and Safety Authority).

o Payment of registration fees and acquisition of number plates. - Ensure that you follow up on the registration promptly, as driving an unregistered vehicle can lead to legal trouble.

Pitfalls to Avoid When Buying an Unregistered Imported Car

1.Inadequate Dealer Verification

- One of the biggest mistakes buyers make is not thoroughly vetting the dealer. Scammers may disappear after receiving the initial deposit or monthly payments

- Always verify that the dealer is licensed and has a track record of successful car deliveries.

2.Unpaid Duties and Taxes

- Sometimes, a dealer may offer a vehicle at a suspiciously low price because import duties and taxes have not been paid. If you buy such a car, the responsibility for clearing the unpaid amounts will fall on you.

- Always confirm with KRA that all dues have been settled before proceeding with the hire purchase.

3.Hidden Charges in Hire Purchase Agreements

- Many hire purchase agreements come with hidden fees, such as administrative costs, insurance premiums, or penalties for early repayment.

- Ensure that you fully understand the total cost of the vehicle and whether the interest rates are fixed or variable.

4.Delays in Registration

- It’s crucial to understand that driving an unregistered vehicle is illegal in Kenya. If there are delays in the registration process due to incomplete documentation, this can lead to fines or even vehicle impoundment.

- Always follow up on the registration process and insist on getting the logbook in your name as soon as possible.

5. Low-Quality or Damaged Vehicles

- Some dealers may offer cars with hidden defects or significant wear and tear. Since the car has not been registered, it may not have undergone thorough inspection by Kenyan authorities.

- Always arrange for a mechanical inspection and a roadworthiness test before making the purchase. A clean exterior doesn’t mean the car is mechanically sound.

6. Defaulting on Payments

- If you default on hire purchase payments, the dealer has the right to repossess the car. This is especially problematic if the car has not yet been registered in your name.

- Ensure that you understand the implications of missed payments and consider your financial stability before entering a hire purchase agreement.

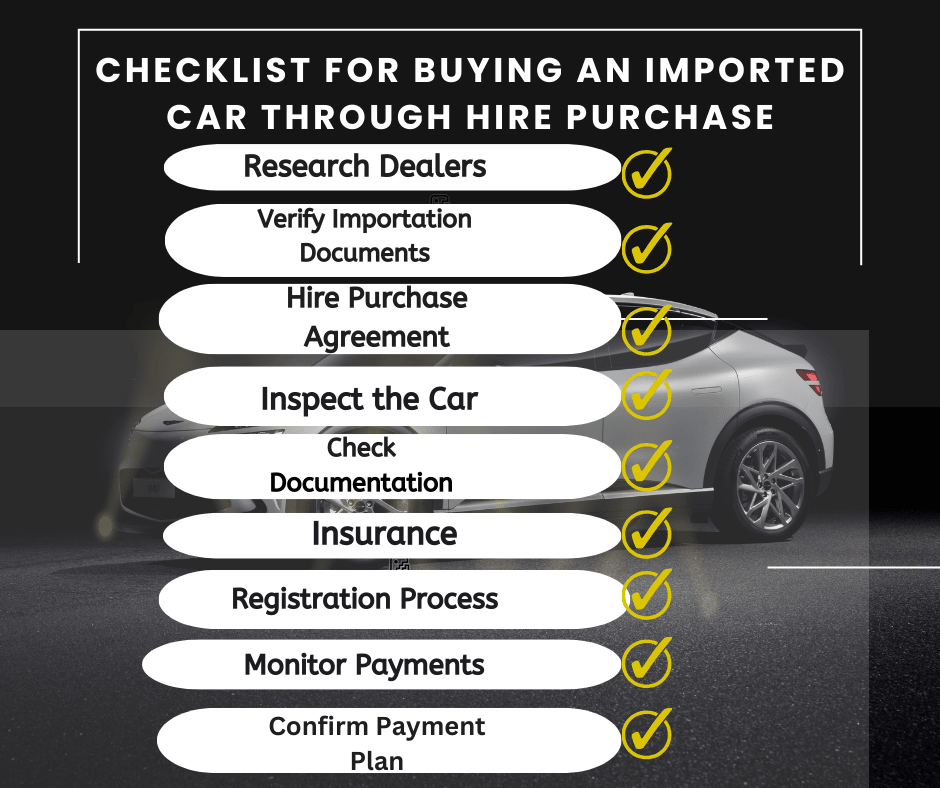

Checklist for Buying an Imported Car through Hire Purchase

Conclusion

Buying an imported car through hire purchase that hasn’t been registered in Kenya requires careful consideration. You must ensure that the car has been legally imported, properly inspected, and that all taxes and duties have been paid. The hire purchase agreement should be clear and transparent, and you should follow through with the registration process as soon as possible.

By following the checklist and avoiding common pitfalls, you can avoid costly mistakes and ensure that the car you purchase is worth the investment.

Remember!

importing your dream car shouldn't be held back by financial constraints. Our comprehensive financial solutions, including asset finance and import duty loans, make the process smoother and more accessible. Whether you need help covering the initial import duties or prefer to spread the cost of your vehicle through our car financing product our experienced team is here to guide you. With competitive rates and tailored payment plans, you can focus on choosing the perfect car while we handle the financial logistics.

Contact us through our contact form, call us on +254791573231 or visit one of our branches to explore financial opportunities.

Comments ()